Renters Insurance in and around Greenwood

Welcome, home & apartment renters of Greenwood!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Calling All Greenwood Renters!

Your rented townhome is home. Since that is where you rest and relax, it can be beneficial to make sure you have renters insurance, even if you think you could afford to replace lost or damaged possessions. Even for stuff like your lamps, exercise equipment, pots and pans, etc., choosing the right coverage can make sure your stuff has protection.

Welcome, home & apartment renters of Greenwood!

Coverage for what's yours, in your rented home

Why Renters In Greenwood Choose State Farm

Renters often don’t realize that their landlord’s insurance only covers the structure. Just because you are renting a apartment or property, you still own plenty of property and personal items—such as a tool set, a video game system, laptop, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why choose renters insurance from Bobby Patterson? You need an agent who can help you evaluate your risks and examine your needs. With dedication and personal attention, Bobby Patterson is waiting to help you keep life going right.

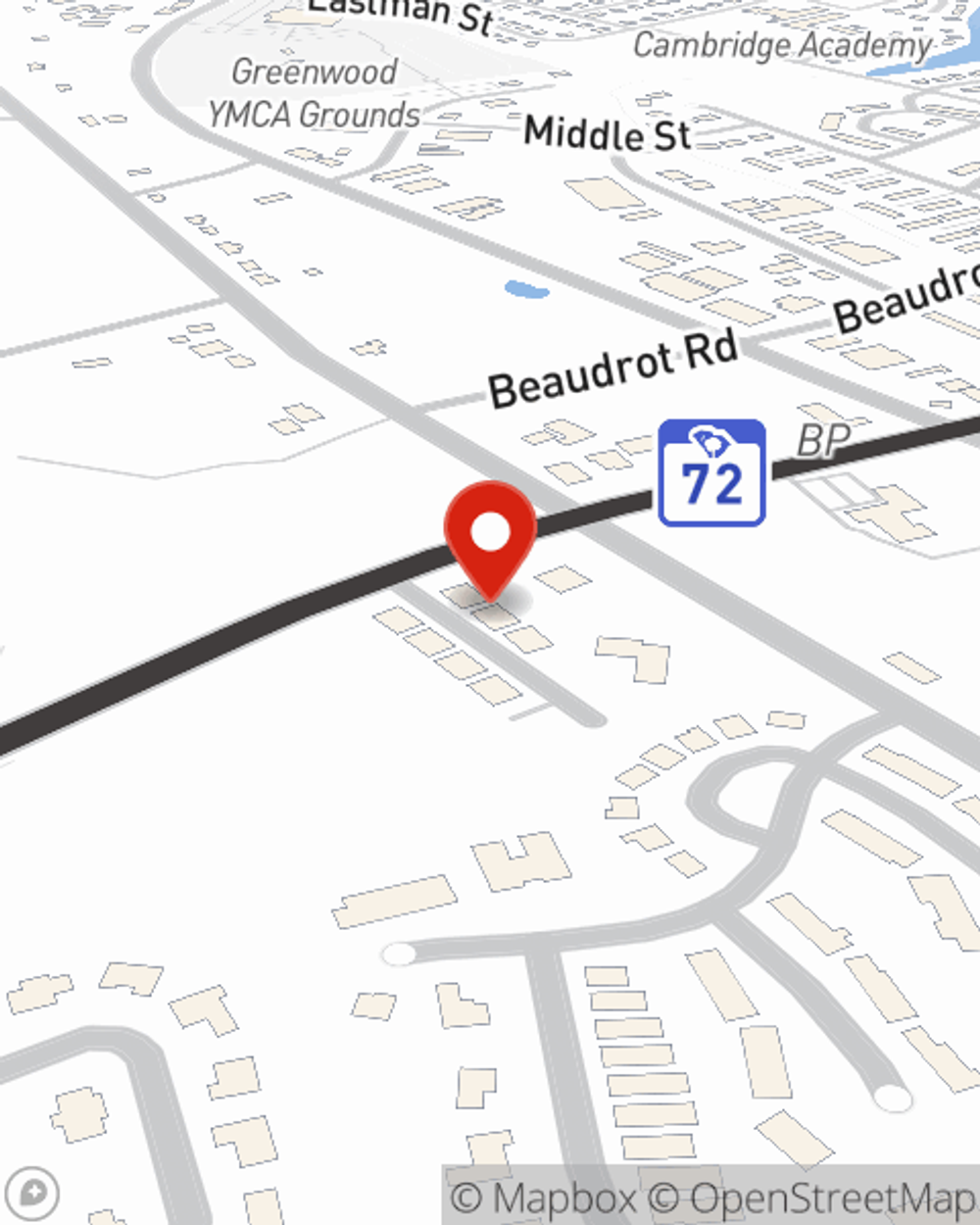

A good next step when renting a apartment in Greenwood, SC is to make sure that you're properly protected. That's why you should consider renters coverage options from State Farm! Call or go online today and find out how State Farm agent Bobby Patterson can help you.

Have More Questions About Renters Insurance?

Call Bobby at (864) 450-9690 or visit our FAQ page.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Bobby Patterson

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.